There was 26000 cash collected from Accounts Receivable. 15 Doints During Year 1 Hardy Merchandising Company purchased 25000 of inventory on account Hardy sold inventory on account that cost 18800 for 28100.

Solved During Year 1 Hardy Merchandising Company Purchased Chegg Com

During 2018 Hardy Merchandising Company purchased 40000 of inventory on account.

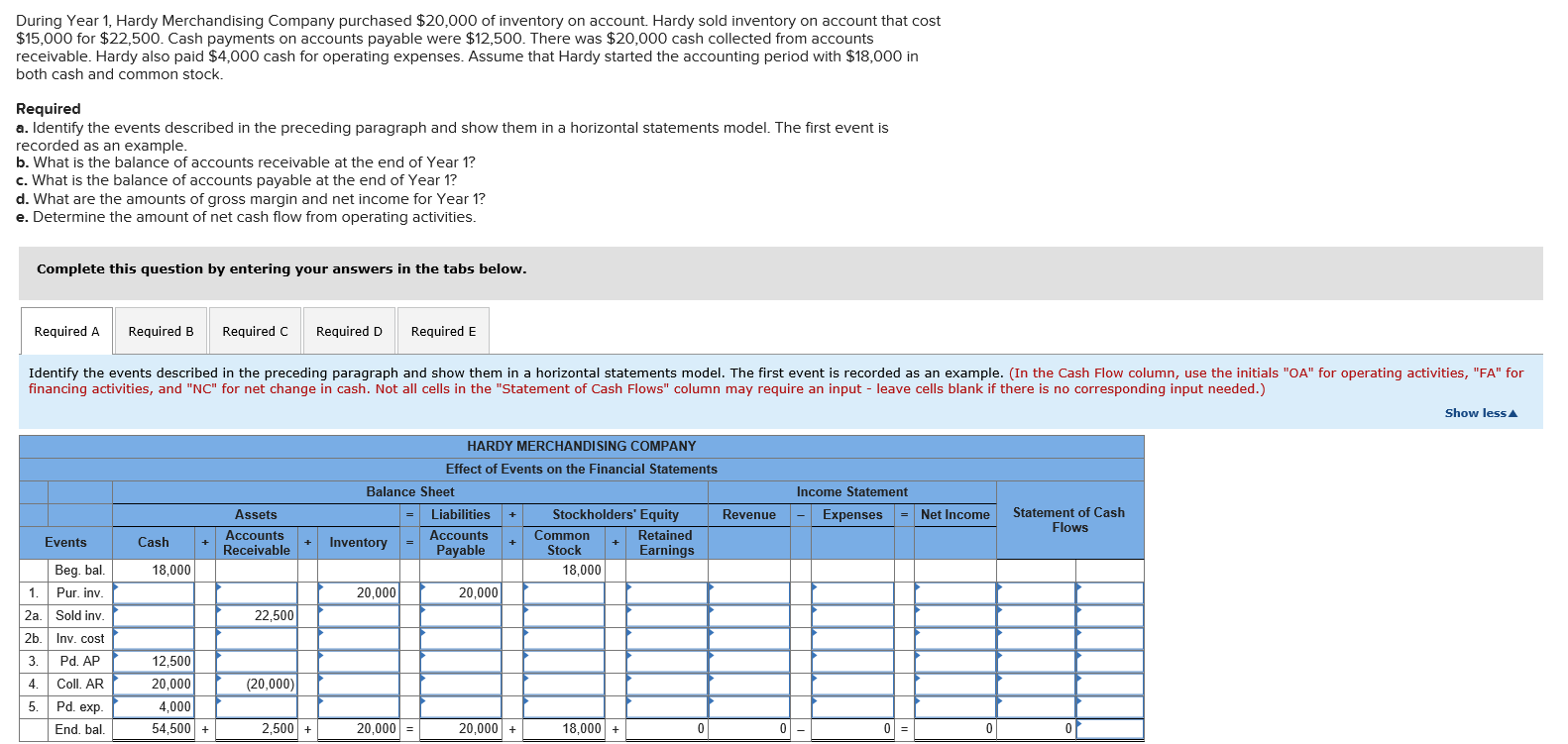

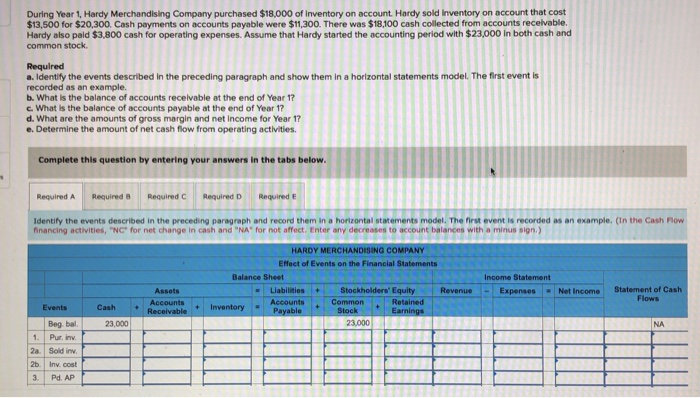

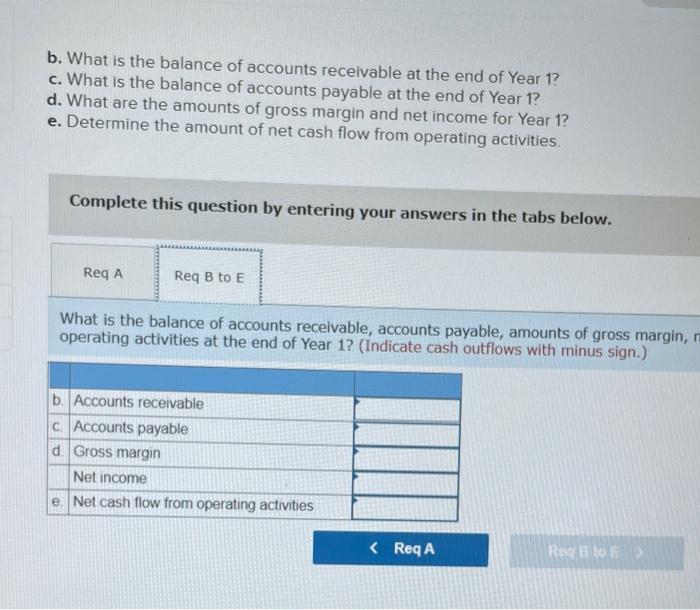

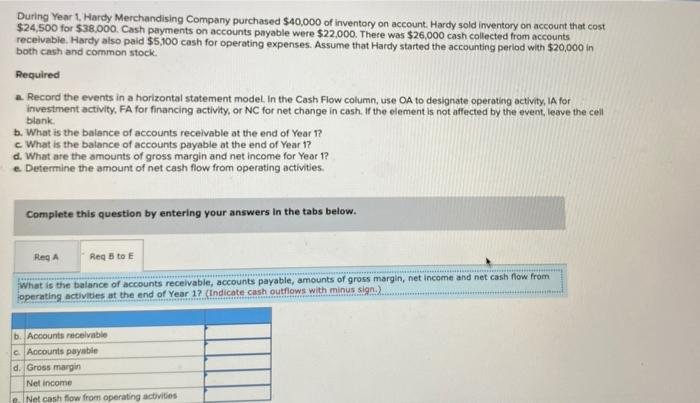

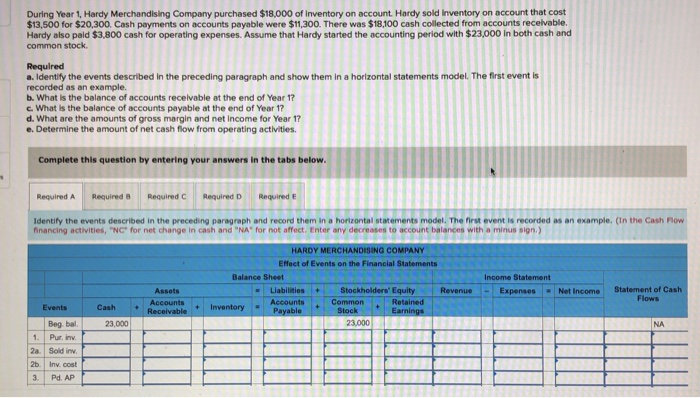

. During Year 1 Hardy Merchandising Company purchased 40000 of inventory on account. Cash payments on Accounts Payable were 22000. Hardy sold inventory on account that cost 24500 for 38000.

Hardy also paid 5100 cash for operating expenses. Cash payments on accounts payable were 22000. Cash payments on accounts payable were 22000.

Hardy sold inventory on account that cost 24500 for 38000. During Year 1 Hardy Merchandising Company purchased 40000 of inventory on account. There was 26000 cash collected from accounts receivable.

Hardy sold inventory on account that cost 24500 for 38000. Hardy sold inventory on account that cost 12800. During 2018 Hardy Merchandising Company purchased 40000 of inventory on account.

Hardy also paid 5100 cash for operating expenses. Hardy also paid 5100 cash for operating expenses. There was 26000 cash collected from accounts receivable.

View Screenshot 309png from ACCT 115 at Drexel University. Cash payments on accounts payable were 8100. Hardy sold inventory on account that cost 24500 for 38000.

Hardy sold inverntory on occount that cost 24500 for 38000. 15 Doints During Year 1 Hardy Merchandising Company purchased 25000 of inventory on account Hardy sold inventory on account that cost 18800 for 28100. Cash payments on accounts payable were 15600.

Cash payments on accounts payable were 22000. Assume that Hardy started the accounting period with. During Year 1 Hardy Merchandising Company purchased 40000 of inventory on account.

There was 26000 cash collected from accounts receivable. Cash payments on accounts payable were 22000. Hardy also paid 5100 cash for operating expenses.

Hardy also paid 3300 cash for operating expenses. During Year 1 Hardy Merchandising Company purchased 17000 of inventory on account. Cash payments on accounts payable were 22000.

Hardy also paid 5100 cash for operating expenses. Hardy sold inventory on account that cost 24500 for 38000. Cash payments on occounts payable were 22000.

Cash payments on accounts payable were 15600. There was 26000 cash collected from accounts receivable. During Year 1 Hardy Merchandising Company purchased 13000 of inventory on account.

During year 1 hardy merchandising company purchased 40000 of inventory on account. Cash payments on Accounts Payable were 22000. Hardy sold inventory on account that cost 9800 for 14600.

During Year 1 Hardy Merchandising Company purchased 40000 of inventory on account. Hardy sold inventory on account that cost 24500 for 38000. Assume that hardy started the accounting.

There was 26000 cash collected from accounts receivable. Hardy also paid 5100 cash for operating expenses. Hardy also paid 5100 cash for operating expenses.

Cash payments on accounts payable were 22000. During 2016 Hardy Merchandising Company purchased 40000 of inventory on account. There was 13000 cash collected from accounts receivable.

There was 26000 cash collected from accounts receivable. There was 26000 cash collected from Accounts Receivable. Hardy sold inventory on account that cost 24500 for 38000.

During Year 1 Hardy Merchandising Company purchased 40000 of inventory on account. Hardy sold inventory on account that cost 24500 for 38000. Hardy also paid 5100 cash for operating expenses.

Solved During Yeat 1 Hardy Merchandising Company Purchased Chegg Com

Solved During Year 1 Hardy Merchandising Company Purchased Chegg Com

Solved During Year 1 Hardy Merchandising Company Purchased Chegg Com

0 Comments